|

|

|

| By Kevin Polega, Director of Sales |

|

Credit Acceptance offers dealers the ability to finance everyone, giving credit-challenged customers the ability to purchase a reliable vehicle. Credit Acceptance offers two programs with our most popular option being the Portfolio Program. The Portfolio Program offers dealers many advantages, which I outlined below.

|

|

| The Portfolio Program gives you an opportunity to earn money in 3 ways: |

|

|

Advance - Upfront cash advance

|

|

|

Portfolio Profit Express (PPE)- When you reach 100 contracts, you may cap the pool* and receive a PPE check, which is 25% of future expected portfolio profit. Additionally, we allow dealer groups (with common ownership) to combine their contracts from multiple stores in order to receive Portfolio Profit Express money earlier. This feature accelerates positive cash flow for dealer groups who opt to participate.

|

|

|

Portfolio Profit - When the total Advance balance in the pool is repaid, 80% of everything Credit Acceptance collects on all 100 deals in the capped pool is sent to you through monthly Portfolio Profit checks.

|

| *Each pool represents a subset of your total portfolio of contracts and serves as a mechanism to help accelerate expected Portfolio Profit, and to give you the opportunity to receive an advance on that future profit in the form of a Portfolio Profit Express check. |

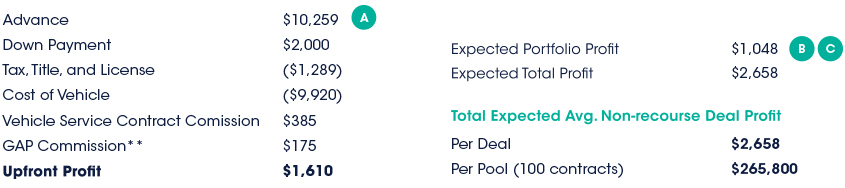

| PORTFOLIO PROGRAM EXAMPLE |

|

|

Below is an example of an average Credit Acceptance contract. This example assumes a vehicle with a selling price of $13,995.

|

|

* GAP not available in all states.

** Portfolio Profit represents the total profit a dealer could expect from Credit Acceptance on this deal. If the contract(s) performs better than

expected, the profit could be greater.

***Expected Total Profit = Upfront profit + Expected Portfolio Profit

|

|

| We currently have established dealers receiving thousands of dollars each month for vehicles they sold years ago on the Portfolio Program, which allows for: |

| Consistent cash flow- When vehicle sales are slow, a continued cash flow can help you meet your overhead, alleviating financial pressure.

|

| Upgrade or increase inventory- Over

time, the improved cash flow received from our program can help improve your inventory. With an increased monthly revenue stream, dealers are able to carry more vehicles as well as newer, lower mileage units. In today’s environment, varied inventory is important to a

dealership’s success.

|

| Long term revenue stream- Building a pool

of business with Credit Acceptance is, in essence, an investment in your dealership’s

future as well as your own. Even if you decide to sell your business or retire one day, your performing contracts can create a revenue stream that will stay with you long after your business.

|

|

| One of the best parts of our programs is that Credit Acceptance manages the collections, from start to finish, enabling you to sell more cars.. |

| While the car business tends to be focused on the money coming in today, with the Credit Acceptance Portfolio Program, you can have the best of both worlds by making a good living today

and generating a revenue stream that lasts for years to come. For more information on either of our programs, contact your Market Area Manager.

|

| Click here to read "Goldstar Motor Company" > |

| Click here to read Monthly Dealer Performance for June 2017 > |

| Click here to read Compliance Corner > |

|

©2017, Credit Acceptance Corporation. All Rights Reserved. The Credit Report is published by:

Credit Acceptance Corporation

25505 West 12 Mile Road

Southfield, MI 48034.

This publication is intended to provide accurate and authoritative information concerning the subject matter covered; however, the publisher is not engaged in rendering legal, professional or other business advice, and this publication is not a substitute for the advice of an attorney or other professional. For authorization to forward or photocopy this publication, or any other concern, please contact

Marketing@CreditAcceptance.com.

|

|

|